October 5, 2012

“The best stock to buy may be the one you already own.” – Peter Lynch

I’m writing today’s CWS Market Review early on Friday morning so I don’t have the results of September’s jobs report (be sure to check the blog for complete coverage). The jobs report will probably be out by the time you’re reading this. But I can say that Wall Street has very modest expectations. The consensus is for a gain of 115,000 jobs. While that’s better than nothing (or a loss), it’s not very robust growth. The rule of thumb is that you need at least 150,000 new jobs each month to bring down the unemployment rate. The ADP report on Wednesday was better-than-expected so that may be a positive omen for today’s report.

The stock market seems, for the time being, to have regained its footing. The S&P 500 has rallied all four days this week, and on Thursday, the index closed at its highest level since September 14th. The stock market is a mere 0.3% away from closing at a 57-month high. A good jobs report could carry us across the line.

Unfortunately, I can’t sound the “all clear” siren just yet. We still have an election to get through, plus more drama in Europe, and most importantly, third-quarter earnings season is only a few days away. I still believe that we’re in for a few bumpy weeks, and I urge investors to be especially cautious right now. But there is some good news to report: Analysts on Wall Street had spent much of this year paring back their earnings forecasts, which the market has mostly ignored, but estimates have stopped trending downward recently. That’s good to see.

In this issue of CWS Market Review, I want to say a few words about politics and its impact on the stock market. I don’t like to write about politics but I will discuss mistakes investors make, and a biggie is letting your political views interfere with a sound investment strategy. I’ll also let you know which stocks on our Buy List look especially attractive right now. (Here’s a preview: Expect to see a very impressive earnings beat from JPMorgan next week.) But first, let’s look at why elections aren’t so important in the eyes of your stock portfolio.

Don’t Let Politics Interfere With Your Investing

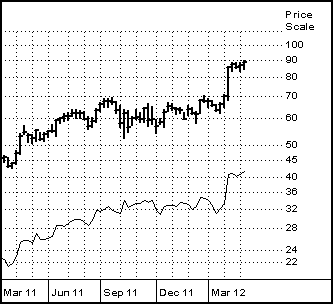

You wouldn’t know it from reading much of the financial commentary but the stock market has had an amazing run. In one year and one day from the 2011 low, the S&P 500 has gained nearly 32% while the Dow has added a cool 2,920 points. That’s more than the whole thing was worth 25 years ago.

I’m also happy to report that our Buy List has continued to thrive. Over the last nine weeks, our Buy List has gained 10.65% compared with just 7.06%. And on Thursday, Buy List standouts Fiserv (FISV), Medtronic (MDT) and Hudson City (HCBK) all hit fresh 52-week highs. Plus, Sysco (SYY) and Harris (HRS) made news highs earlier this week. If you recall from last week’s newsletter, I urge you to focus on high-yielding Buy List stocks.

I was amused this week when I heard market pundits attribute Thursday’s rally to Mitt Romney’s debate performance. Sure, that could be the reason, but honestly, I doubt it. For one, this theory conveniently skips over the fact that the market opened slightly on Thursday. The rally continued throughout the day, well after the market had the opportunity to digest the outcome of the debate.

This argument beings me to a mistake that too many investors make—they let their political opinions seep into their investing strategy. I like to call this the “Larry Kudlow Fallacy,” after the CNBC pundit and former Reagan official who can always find his political views confirmed by whatever happened on Wall Street that day.

Don’t mistake me as saying that the market doesn’t care about policy. Public policy can have a major impact on the financial markets. But the market is surprisingly indifferent to the standard back-and-forth bickering of partisan politics. Stock prices are chiefly concerned with earnings and interest rates, and very little else.

The stock market has performed well under Republicans and Democrats. The market has performed poorly under both as well. And of course, just because one party controls the executive mansion doesn’t mean that they have absolute power. Presidents routinely find their agendas frustrated by Congress or the courts or even public opinion. Any investor who bailed out when President Obama took office missed one of the greatest rallies in history.

I’ll give you an example of a small story that’s probably far more important to stocks and bonds than anything discussed at the debates. The minutes from the FOMC’s September meeting indicate that several members believe the Fed ought to tie their interest rate policy to some economic metric. The minutes didn’t specify which metrics were discussed. If they mean employment, that probably means that short-term rates will stay low for quite some time. This would be a huge benefit for dividend-paying stocks, and companies like Nicholas Financial (NICK) that rely on short-term funding.

In fact, a bigger event for U.S. stock prices may not even be happening in this country. Over the past few days, the Iranian currency has completely fallen apart. The Iranian rial plunged 59% in one week. I won’t even try to guess what the fallout will be.

Let’s remember the important lesson: The key for being a successful investor is being disciplined. You need to be disciplined in the stocks you select. Disciplined in when you sell. And most importantly, you must be disciplined in holding on during lousy markets. All of these involve holding your emotions at bay, and people can be very passionate about politics. Don’t let the elections rattle you or change your strategy of investing in high-quality stocks. Once the election passes, I see a strong year-end rally forming especially for our stocks on the Buy List.

Expect an Earnings Beat from JPM

Here are a few notes on some of our Buy List stocks. I continue to like Ford (F) a lot. If you can get it below $10 per share, then you’ve gotten a very good deal. Truck sales at Ford are pace for their best year since 2007. Ford is a buy up to $12.

The fraud suit brought against JPMorgan Chase (JPM) made a lot of news this week, but there’s less there than meets the eye. I think this was a bit of political grandstanding before the election. Plus, all this happened with Bears Stearns which the government pleaded with JPM to buy.

Look for another good earnings report from JPM next Thursday, October 11. Wall Street currently expects earnings of $1.21 per share. My numbers say that JPM will easily beat that. JPMorgan is a good buy up to $43 per share.

One of the best values on our Buy List is Moog (MOG-A). At $38, the stock is a very strong buy. I rate Moog a strong buy up to $45.

Before I go I want to say that I was impressed by this week’s ISM report which finally ticked back over 50. The report came in at 51.5. Any number above 50 means the manufacturing sector is expanding. This was the best report since May.

That’s all for now. We’ll get some early earnings reports next week. The first Buy List stock to report will be JPMorgan which reports on Thursday. Look for a big earnings beat. I’ll also be curious to see the Fed’s Beige Book which comes out on Wednesday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Named by CNN/Money as the best buy-and-hold blogger, Eddy Elfenbein is the editor of Crossing Wall Street. His free Buy List has beaten the S&P 500 for the last five years in a row. This email was sent by Eddy Elfenbein through Crossing Wall Street.

Named by CNN/Money as the best buy-and-hold blogger, Eddy Elfenbein is the editor of Crossing Wall Street. His free Buy List has beaten the S&P 500 for the last five years in a row. This email was sent by Eddy Elfenbein through Crossing Wall Street.