CWS Market Review

January 30, 2015

“Go for a business that any idiot can run—because sooner

or later, any idiot probably is going to run it.” – Peter Lynch

The strong U.S. dollar is finally making its presence felt on the income statement. So far, the reported earnings for our Buy List stocks have been quite good. However, this week, two of our big-name tech stocks, Qualcomm (QCOM) and Microsoft (MSFT), got pinged for big losses, as their outlook wasn’t as rosy as Wall Street had hoped. In both cases, the rising dollar has taken a bite out of earnings, and they’re not alone. I’ll have more details on those two in a bit.

Overall, earnings season is going OK, but not great; 77% of the companies that have reported have topped earnings expectations. Of course, we have to remember that estimates for Q4 were pared back a lot in the last several weeks. Looking at the top line, 58% of the earnings results so far have beaten their sales expectations. Right now, it looks like earnings are growing, but at a very subdued pace.

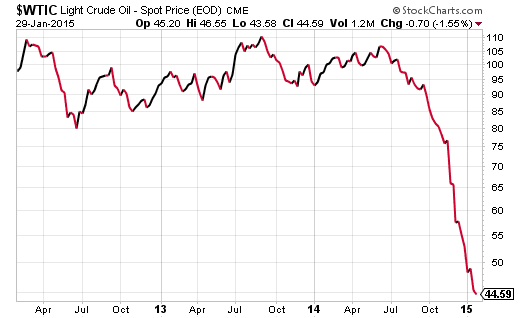

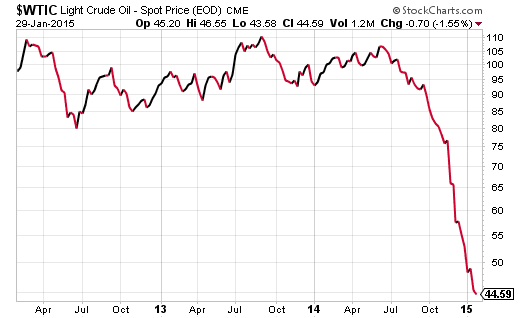

But the real drama continues to be the forex and bond markets. This week, the Federal Reserve said it was going to be “patient” in its desire to raise short-term interest rates. The bond market took the clue, and the yield on the 30-year Treasury plunged below 2.8% to its lowest yield ever (see above). The dollar seems unstoppable, and I think the euro and the dollar could soon reach parity for the first time in 12 years.

In this week’s CWS Market Review, I’ll tell you what the Fed’s “patience” means for us and our portfolios. I’ll also go over our recent earnings reports. Despite the bad news from Qualcomm and Microsoft, we had some solid results as well—CR Bard just capped off an outstanding year. Later on, I’ll preview the five earnings reports we have next week. (You can see our complete Earnings Calendar.) But first, let’s look at why the Fed may not be touching interest rates at all this year.

The Federal Reserve Says “It Can Be Patient”

The Federal Reserve met again this week and on Wednesday afternoon, the central bank released its latest policy statement. The Fedspeak was largely the same as the one from December, but they added several optimistic edits. In fact, it was probably the Fed’s most cheerful outlook for the economy in years. (Central bankers are rarely optimistic.) It’s taken a while, but things are clearly improving. The fewest number of Americans filed for first-time jobless claims in nearly 15 years.

For the last several months, the Fed has hinted that short-term rates will start to rise sometime in the middle of this year. Gradually, I’ve grown to doubt that timetable. Now it appears that the Fed and the bond market are catching on. I think it’s now very possible that we won’t see a rate increase until 2016. In fact, Morgan Stanley just pushed their expectations for a rate hike to Q1 of next year. Of course, even when rates do rise, they will still be well below the rate of inflation.

The key sentence in the Fed’s policy statement read: “Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.” That’s about as exciting as central bankers get, but the message is clear: Until wages pick up, the Fed simply isn’t going to do much of anything.

What does the continuation of low rates mean? It’s very good for stock investors. If rates are going to stay low, even modest dividend yields of 2% or 3% are very inviting. It’s simple math. Ford Motor(F), for example, recently raised its dividend by 20%. The automaker currently yields 4%, which beats most anything you’ll find in the bond market. (I’ll have more on Ford’s earnings in just a bit.)

This entire dynamic is due to the Strong Dollar Trade. Actually, the dollar got even stronger against the euro after the left-wing Syriza party won in Greece. The rising dollar has put the squeeze on commodity prices. This means that right now, we’re experiencing deflation. On Monday, gasoline prices rose for the first time in 123 days. That won’t last long. Last month, U.S. oil inventories rose to their highest level for December since 1930. On Thursday, West Texas Crude briefly dropped below $44 per barrel. A lot of Energy and Materials stocks are in rough shape.

Wall Street had been expecting the dollar to take a bite out of Q4 earnings, but I think they were surprised by how large the impact was. In October, Wall Street expected the S&P 500 to post Q4 earnings growth of 8.5%. That’s now down to 1.1%. The strong dollar is having its greatest impact on U.S. manufacturing. We can see evidence of that in the last two durable-goods reports, which were quite weak.

Firms are already cutting back on capital spending. Caterpillar (CAT), for example, which is a Dow component, said they’re cutting their spending plans. Even consumer-products companies are feeling the heat. Procter & Gamble (PG) said the strong dollar could reduce their earnings this year by $1.4 billion; nearly half that is due to the Russian ruble. I also suspect that a lot of companies are jumping in on the strong-dollar excuse so they can temper expectations for the rest of this year. Now let’s take a look at some of our Buy List earnings reports from this week.

Our Recent Buy List Earnings Reports

For the most part, our Buy List stocks have reported good earnings, but the market hasn’t always reacted positively. On Monday, Microsoft (MSFT) reported Q4 earnings of 71 cents per share. That exactly matched Wall Street’s estimates, but the stock dropped more than 9% on Tuesday.

The problem was their forecast for the rest of this year (Microsoft’s fiscal year ends in June). PC sales have been somewhat sluggish, and Microsoft’s commercial software was surprisingly weak. That had been a recent bright spot for the software giant. Microsoft also cited—I hope you’re sitting down—the recent strength of the U.S. dollar as a negative factor. They said currency exchange will lower revenues by 4% this quarter. The company said they were expecting sales declines in China, Russia and Japan.

While this news is disappointing, most of the key factors such as currency and geopolitics are outside of MSFT’s control. I like Microsoft a lot, and I think Nadella has done a commendable job. To adjust for this week’s pullback, I’m lowering my Buy Below on Microsoft to $45 per share.

Our other tech dud was Qualcomm (QCOM). But like Microsoft, the results were quite good. For Q4, Qualcomm earned $1.34 per share for Q4, which topped estimates by nine cents per share.

The problem was guidance. Qualcomm had previously said to expect full-year 2015 results of $5.35 per share. Now they say it will range between $4.75 and $5.05 per share. Sales will range from $26 billion to $28 billion. On Thursday, the shares dropped 10.3% to close at $63.69. Ouch!

Qualcomm said that a major customer decided against using their Snapdragon chip in a flagship phone design. The company has long had the field to themselves, and they’re starting to face some competition. I have faith in CEO Steve Mollenkopf and his team. Qualcomm is still a good buy, but I’m lowering my Buy Below to $66 per share.

On Tuesday, Stryker (SYK) reported Q4 earnings of $1.44 per share. That was one penny below expectations. For all of 2014, the company made $4.73 per share.

For Q1, Stryker expects earnings to range between $1.05 and $1.10 per share; for the entire year, they see earnings coming in between $4.90 and $5.10 per share. Wall Street had been expecting $1.17 per share for Q1 and $5.14 per share for the whole year.

Shares of Stryker actually climbed on the light guidance. I think investors understood that aside from the dollar, Stryker’s business is going quite well. This is a good stock. Stryker remains a buy up to $98 per share. I think it’s very likely that Stryker will do a big deal this year.

CR Bard (BCR) continues to be one of our brightest stocks. This week, the medical-devices company reported Q4 earnings of $2.29 per share. That was five cents better than estimates. Sales rose to $867.2 million, which beat expectations by $9.5 million.

CEO Timothy M. Ring said, “Two years ago we announced a strategic investment plan with the objective to shift the mix of the portfolio to faster growth through investments in emerging markets and new product development. We said at the time that we expected the early returns from those investments to begin in the back half of 2014. We are pleased with the performance of our investment plan so far, as we delivered accelerating organic revenue growth throughout 2014. We remain focused on executing our plan with the objective of improving the long-term growth profile of the company in a profitable manner that adds value for shareholders.”

For all of 2014, Bard earned $8.40 per share. That’s a very nice increase from $5.78 per share in 2013. The stock has doubled for us in just over three years. This week, I’m raising my Buy Below on CR Bard to $184 per share.

Last week, I said not to place too much emphasis on Ford Motor’s (F) Q4 earnings report. The results later this year will be far more important, but Ford had a decent Q4. They earned 26 cents per share, which beat estimates by three cents per share.

Ford’s core business continues to be trucks sold in North America, and that’s going well. The bad news for Ford is Europe, which appeared to be improving. Ford is turning things around in the Old World, but not as quickly as they had expected.

The most important news for us is that Ford is sticking by its 2015 forecast for a pretax profit between $8.5 billion and $9.5 billion. That’s very good news. Until now, I’ve kept a wide range for our Buy Below price, but I want to tighten that little bit. This week, I’m lowering my Buy Below on Ford to $16 per share, but this is in no sense a downgrade.

Next Week’s Buy List Earnings Reports

We have five more earnings reports due next week. On Tuesday, AFLAC and Fiserv will report. Cognizant Technology Solutions follows on Wednesday. Then two of our new stocks, Ball Corp. and Snap-on, will report on Thursday. As always, check the blog for the latest updates.

AFLAC (AFL) has been one of our more frustrating stocks because the company has done very well from a standpoint of operations. It’s an efficient and well-run company. However, their financial results have been greatly impacted by the sinking yen. AFLAC does a ton of business in Japan, and the government there has been trying to bring down its currency relative to the U.S. dollar. That means that AFLAC’s profits get stung when the money is translated from yen into dollars.

In October, AFLAC said it was expecting Q4 operating earnings to range between $1.28 and $1.37 per share. But that was assuming the yen stayed between 105 and 110 to the dollar. It’s currently at 118.23. For 2015, AFLAC aims to increase their operating earnings by 2% to 7% on a currency-neutral basis.

Three months ago, Fiserv (FISV) raised their expectations for Q4. They now see quarterly earnings between 86 and 90 cents per share. That means full-year 2014 earnings of $3.34 to $3.38 per share, up from $2.99 per share for 2013. The shares hit another new all-time high this week. I’ll be curious to see if they provide guidance for 2015. Fiserv is one of my favorite long-term holdings.

Cognizant Technology Solutions (CTSH) had an outstanding earnings season three months ago. From October 20 to November 7, the shares rallied 23%. The IT outsourcer raked in 66 cents per share for Q3, which was seven cents better than estimates. Quarterly revenues jumped 11.9% to $2.58 billion.

For Q4, Cognizant sees earnings of at least 63 cents per share. Wall Street had only been expecting 59 cents per share. That would bring full-year earnings to at least $2.57 per share. CTSH also said they expect revenues to range between $2.61 and $2.64 billion. That was above the Street’s forecast of $2.59 billion. Last Friday, the shares hit an all-time high of $56.62 per share.

Ball Corp. (BLL) is a brand-new member of our Buy List. The company is the largest producer of recyclable beverage cans in the world. Ball also has an aerospace unit that makes parts for NASA. They’re somewhat boring, but very profitable. Ball has beaten earnings for the last five quarters in a row. Wall Street currently expect 85 cents per share for Q4.

Snap-on (SNA) is another new stock for us. They’re a maker of high-end hand and power tools. They also make lots of machines for car repair, like hydraulic lifts and tire changers. Snap-on makes products for the marine, rail and aviation industries. In November, Snap-on raised their dividend by 20.5%. Wall Street’s consensus for Q4 is $1.81 per share.

That’s all for now; there are still more earnings reports to come next week. On Monday, we’ll get the ISM report for January. On Tuesday, the report on factory orders comes out. This leads up to the big January jobs report on Friday morning. The unemployment rate for December was 5.6%, which is a six-year low. The number for January may be even lower. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy